There are lots of ways to transfer money to and from Australian dollars.

- Withdraw from an ATM in Australia using a debit card in another currency

- Use a credit card to pay for something in Australia

- Use a money transfer service such as Western Union

- Exchange cash at the airport

- Exchange cash at another money transfer agency

- Transfer money using a bank

- PayPal

- Bitcoin?

So let’s start with the banks. How much do banks charge when transferring money? Let’s find out.

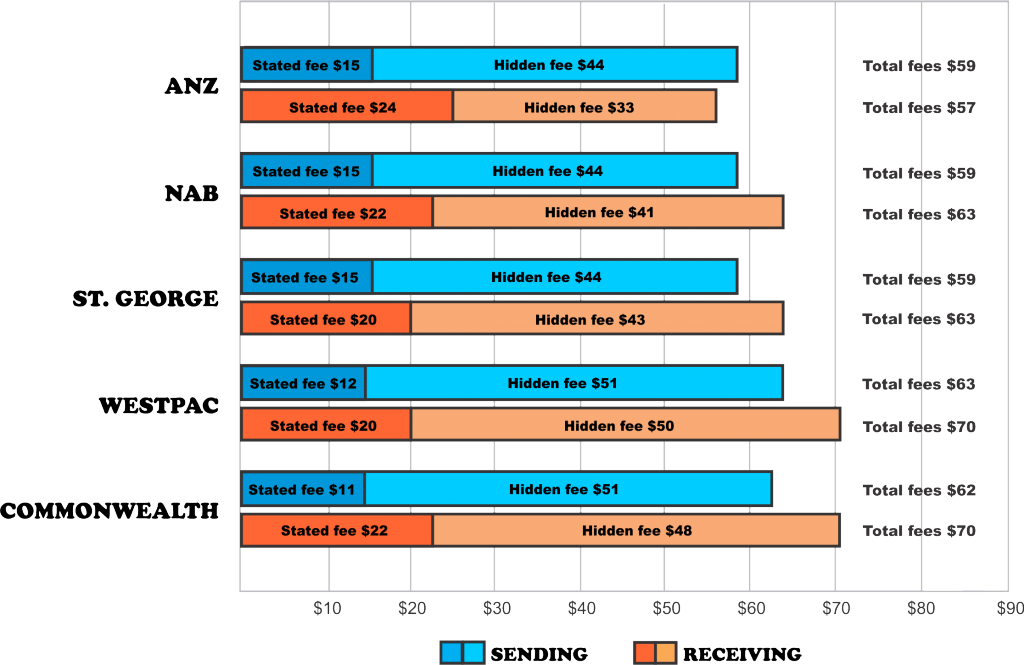

How much do Australian banks charge when transferring $1000?

This is for transfers between US and Aussie dollars. Sending to or receiving from the US.

Note regarding this table: These incredibly high rip-off fees are actually the LOWEST fees the bank charge for international transfers! If you exchange cash over the counter the fees are higher. If you transfer money to a less popular currency such as Thai Baht the fees are even higher still!

Unfortunately it’s not only the banks that charge hidden fees. Let’s find out more about these hidden fees…

Whatever method you use there are HIDDEN FEES

There are two types of fees, the declared fee, and the hidden fee which is a margin that they put on the exchange rate. There is the REAL exchange rate and there is the exchange rate that they give you. The difference is a hidden fee. ALMOST EVERY transfer method has hidden fees. And it’s difficult to find out what they are because they are not declared in most cases!

So if you wire money using your bank, there are hidden fees that your bank will charge or the recipient will be charged. If you use Western Union, there are hidden fees. If you exchange money at the airport where it says “No fees” there are DEFINITELY hidden fees, and in fact probably the largest hidden fees you can possibly pay are at the airport money exchange counter! If you withdraw money at an ATM there are also hidden fees.

Since banks don’t declare how much their hidden fees are, it’s really hard to calculate how much you are getting charged.

If you are using an Australian bank to exchange money then you’re in particularly bad shape because Australian banks like to charge large hidden fees for exchanging money.

Which transfer methods are ripping you off with large hidden fees?

So basically the answer is, if you’re using a bank you are going to get ripped off. If you use a credit card or debit card you will also get ripped off with large hidden fees. If you transfer money at the airport you will get the largest hidden fees possible. If you use PayPal there are also large hidden fees.

What about Bitcoin?

Everyone is talking about Bitcoin but unfortunately there are large exchange fees when trying to transfer from Australian dollars to Bitcoin or vice-versa using a Bitcoin exchange. So Bitcoin is also not a good option in Australia at least.

What if I’m going overseas (for example to Thailand, to the US or to Europe), what’s the best way to exchange money?

The lowest cost way is to send money using one of the money transfer services in the tables below in this article (such as Wise, formerly TransferWise). However this means that you need to have a bank account in the receiving country. If this is not possible then the second best way is usually to exchange cash in the other country (not in Australia).

What if I sold my house in Australia and then I want to transfer the money to another country to buy a house in another country (or vice versa)?

In this case it’s a large amount of money and you need to know that you’re getting the best exchange rates. You will get screwed if you use the banks to do this. So the first step is to get a bank account in the receiving country. So if you’re moving from Australia to the US, get a bank account in the US. Then use one of the services mentioned in the article. If it’s a large amount of money you can probably negotiate a discount on their fees.

What if I want to pay a worker in another country such as the Philippines?

We actually have an article specifically on sending money to the Philippines here.

We also have articles about transferring money to: Kenya, Indonesia, Pakistan, Egypt, Mexico, India, Colombia, Romania, Macedonia, Bangladesh, Bolivia, Serbia, Poland and Ukraine

What transfer methods do we use at Time Doctor?

We have a remote team with people in 19 different countries around the world. The two transfer methods we use the most are:

- Wise ,formerly TransferWise – is a new kind of financial company that you can use to transfer money internationally at a very low cost. Their system is based on local bank account transfers, which makes transfers abroad cheaper than what banks or other providers charge. They charge a small upfront fee between 0.5% and 2% for transactions, depending on the route.

- Payoneer – very convenient for sending and receiving. They are also one of the few methods that works to receive money in almost every country and the receiver can get their money on a debit card and withdraw from an ATM. They also have an option for direct transfer to the receiver’s bank account. They also have a $50 bonus if you receive more than $100 through this method.

Tables comparing money transfer services including the cost of hidden fees

The good news are that there are now some FinTech companies that are popping up as alternatives to the banks. They give you a much lower cost alternative for transferring money into Australia. The tables below give you a comparison of these cheaper options.

| Table 1: Sending $1000 from the US to Australia | ||||

|---|---|---|---|---|

| Transfer method | Fees to send $1000 USD | Hidden currency conversion cost | Total fees | Time for the transfer to arrive |

| OFX (previously USForex)* | $0 | $7.5 | $7.5 | 1-2 days |

| Wise, formerly TransferWise | $10 | $0 | $10 | 1-2 days |

| WorldRemit* | $4 | $8 | $12 | 1-3 days |

| Tranzfers | $5 | $15 | $20 | 3-5 days |

| Xpress Money | $13 | $7 | $20 | 3-5 days |

| 1st Contact Forex | $10 | $16 | $26 | 3-5 days |

| Ria Money Transfer (slow) | $5 | $21 | $26 | 3-5 days |

| Paysera | $4 | $30 | $34 | 1-3 days |

| Ria Money Transfer (fast) | $15 | $21 | $36 | In Minutes |

| Xoom (slow) | $5 | $32 | $37 | 1-3 days |

| Western Union (slow) | $5 | $36 | $41 | 7-9 days |

| Zenbanx | $5 | $49 | $54 | 2-3 days |

| Wire transfer | $25-40 | $33-48 | $58-88 | 3-5 days |

| Skrill | $4 | $58 | $62 | 3-5 days |

| MoneyGram (slow) | $25 | $40 | $65 | 4-6 days |

| Western Union (fast) | $40 | $36 | $76 | 3-5 days |

| Xoom (fast) | $51 | $32 | $83 | In Minutes |

| Travelex | $0 | $118 | $118 | 3-5 days |

| MoneyGram (fast) | $81 | $40 | $121 | In Minutes |

Notes:

- For Paypal, the fee is zero if sending to a friend or relative and up to 4% if it’s a business transaction.

- Minimum transfer of $500 for OFX (previously USForex).

| Table 2: Sending £1000 from the UK to Australia | ||||

|---|---|---|---|---|

| Transfer method | Fees to send £1000 GBP | Hidden currency conversion cost | Total fees | Time for the transfer to arrive |

| Wise, formerly TransferWise | £7 | £0 | £7 | 1-2 days |

| Azimo | £1 | £6 | £7 | 1-3 days |

| OFX* | £0 | £7.5 | £7.5 | 1-2 days |

| Western Union | £3 | £5 | £8 | 3-5 days |

| CurrencyFair* | £4 | £6 | £10 | 2-4 days |

| WorldRemit | £3 | £14 | £17 | 1-3 days |

| OrbitRemit | £5 | £12 | £17 | 2-4 days |

| Tranzfers | £7 | £14 | £21 | 1-3 days |

| FairFX | £0 | £23 | £23 | 1-3 days |

| GlobalWebPay | £5 | £21 | £26 | 1-3 days |

| Exchange4free | £0 | £26 | £26 | 3-5 days |

| 1st Contact Forex | £2 | £26 | £28 | 1-3 days |

| Travelex | £0 | £29 | £29 | 3-5 days |

| Easy Exchange | £6 | £24 | £30 | 1-5 days |

| Xpress Money | £20 | £10 | £30 | 3-5 days |

| First Remit | £20 | £14 | £34 | 1-3 days |

| Paysera | £2 | £34 | £36 | 1-3 days |

| Skrill | £4 | £45 | £49 | 3-5 days |

| Small World FS | £5 | £59 | £64 | 1-3 days |

| MoneyGram | £41 | £40 | £81 | In Minutes |

Note:

- Minimum transfer of £500 for UKForex.

- Five free transfers with CurrencyFair

| Table 3: Sending $1000 from Canada to Australia | ||||

|---|---|---|---|---|

| Transfer method | Fees to send $1000 CAD | Hidden currency conversion cost | Total fees | Time for the transfer to arrive |

| OFX* | $0 | $7.5 | $7.5 | 1-2 days |

| CurrencyFair* | $4 | $6 | $10 | 4-6 days |

| Wise, formerly TransferWise | $12 | $0 | $12 | 1-2 days |

| WorldRemit* | $4 | $8 | $12 | 1-3 days |

| Paysera | $5 | $22 | $27 | 1-3 days |

| Exchange4free | $0 | $31 | $31 | 3-5 days |

| Tranzfers | $15 | $16 | $31 | 3-5 days |

| Xpress Money | $16 | $15 | $31 | 3-5 days |

| 1st Contact Forex | $10 | $23 | $33 | 1-3 days |

| Zenbanx | $6 | $40 | $46 | 2-3 days |

| Skrill | $4 | $48 | $52 | 3-5 days |

| Western Union (slow) | $25 | $28 | $53 | 2-4 days |

| Western Union (fast) | $40 | $28 | $68 | In Minutes |

| MoneyGram | $50 | $39 | $89 | In Minutes |

| Travelex | $0 | $114 | $114 | 3-5 days |

Note:

- Minimum transfer of $500 for OFX.

- Five free transfers with CurrencyFair

| Table 4: Sending €1000 from Western Europe to Australia | ||||

|---|---|---|---|---|

| Transfer method | Fees to send €1000 EUR | Hidden currency conversion cost | Total fees | Time for the transfer to arrive |

| Wise, formerly TransferWise | €7 | €0 | €7 | 1-2 days |

| OFX | €0 | €7.5 | €7.5 | 1-2 days |

| CurrencyFair* | €3 | €7 | €10 | 3-5 days |

| Azimo | €3 | €12 | €15 | 1-3 days |

| Paysera | €3 | €12 | €15 | 1-3 days |

| WorldRemit | €4 | €11 | €15 | 1-3 days |

| Exchange4free | €0 | €24 | €24 | 3-5 days |

| Tranzfers | €10 | €14 | €24 | 3-5 days |

| 1st Contact Forex | €5 | €23 | €28 | 1-3 days |

| Western Union | €0 | €30 | €30 | 3-5 days |

| First Remit | €25 | €20 | €45 | 1-3 days |

| Xpress Money | €40 | €9 | €49 | 3-5 days |

| Skrill | €4 | €48 | €52 | 3-5 days |

| Travelex | €0 | €53 | €53 | 3-5 days |

| Small World FS | €0 | €70 | €70 | 3-5 days |

| MoneyGram | €34 | €41 | €75 | In Minutes |

Note:

- Minimum transfer of €500 for OFX.

- Five free transfers with CurrencyFair

| Table 5: Sending $1000 from New Zealand to Australia | ||||

|---|---|---|---|---|

| Transfer method | Fees to send $1000 NZD | Hidden currency conversion cost | Total fees | Time for the transfer to arrive |

| Wise, formerly TransferWise | $7 | $0 | $7 | 1-2 days |

| OFX* | $0 | $7.5 | $7.5 | 1-2 days |

| CurrencyFair* | $5 | $5 | $10 | 3-5 days |

| WorldRemit | $4 | $12 | $16 | 1-3 days |

| OrbitRemit | $8 | $14 | $22 | 2-4 days |

| Travelex | $0 | $24 | $24 | 3-5 days |

| Tranzfers | $12 | $15 | $27 | 3-5 days |

| 1st Contact Forex | $5 | $23 | $28 | 1-3 days |

| Exchange4free | $0 | $30 | $30 | 3-5 days |

| Paysera | $5 | $41 | $46 | 1-3 days |

| Xpress Money | $25 | $25 | $50 | 3-5 days |

| Western Union | $25 | $27 | $52 | Minutes |

| Skrill | $4 | $48 | $52 | 3-5 days |

| MoneyGram | $25 | $28 | $53 | Minutes |

Note:

- Minimum transfer of $500 for OFX.

- Five free transfers with CurrencyFair

Table 6: Various options for sending money from Australia to other countries:

There are hundreds of options of countries where you can send the money to so we’ve simplified this table to a few of the lower cost options. We’ve stated the fees for sending to the US only. The fees are going to be different for other countries, but this gives you a general indication of their level of fees:

| Table 6: Options for Sending Money from Australia to other countries | |||

|---|---|---|---|

| Transfer option | Where can you transfer to? | Fee to send $1k AUD to the US | Time to arrive |

| Wise, formerly TransferWise | Western Europe, UK, India, Philippines, USA, UAE, Australia, Bulgaria, Brazil, Canada, Switzerland, Chile, Czech Republic, Denmark, Georgia, Hong Kong, Hungary, Indonesia, Morocco, Malaysia, Nigeria, Norway, New Zealand, Pakistan, Poland, Romania, Sweden, Singapore, Thailand, Turkey, Ukraine | $7 | 1-2 days |

| CurrencyFair | UAE, Canada, Switzerland, Czech Republic, Denmark, Western Europe, UK, Hong Kong, Hungary, Israel, Norway, New Zealand, Poland, Sweden, Singapore, USA, South Africa | $7 | 1-3 days |

| OFX (previously OzForex) | UAE, Australia, Canada, Switzerland, Denmark, Western Europe, UK, Hong Kong, Japan, Mexico, Norway, New Zealand, Poland, Sweden, Singapore, Thailand, USA, South Africa, Brunei, China, Czech Republic, Fiji, Hungary, Indonesia, Israel, India, South Korea, Kuwait, Sri Lanka, Morocco, Madagascar, Malaysia, Oman, Peru, Papua New Guinea, Philippines, Pakistan, Saudi Arabia, Solomon Islands, Seychelles, Tonga, Turkey, Taiwan, Vietnam, Vanuatu, Samoa, West Africa, French Overseas Collectivities | $7.5 – (OFX fees are a lot less expensive for larger transfers) | Same day for the US; 1-2 days otherwise |

| MoneyGram | Almost every country | $65 | In minutes |

| Western Union | Almost every country | $20 | In minutes |

Summary:

Ok so what’s the best way to transfer money from and to Australia, just tell me what it is!

If you’re able to send to a bank account in another country (for example you have a friend or relative there or you have a bank account in both countries, then these three currency transfer methods are good options: Wise, formerly TransferWise, CurrencyFair and OFX (previously OzForex).

If you traveling on a holiday then usually bringing cash will give you the best exchange rate, however you need to be careful where you exchange money (the airport has very high hidden fees for example)

Whatever you do, avoid the banks! They have large hidden fees and the costs to exchange money are very high.

Rob Rawson is a co-founder of Time Doctor which is software to improve work productivity and help keep track of what your team is working on, even when working remotely.