A perceived lack of fair or competitive compensation is a major reason for employee turnover, and ‘compensation’ includes more than a person’s take-home pay packet. It pays to understand the varied ways you can compensate employees—including comp time—and how to do so while staying within the law.

Table of Contents

- What is comp time?

- Is comp time legal?

- When and why should you provide comp time?

- How do you calculate comp time?

- How is Time Doctor used to track comp time?

What is comp time?

Compensatory time off is a straightforward idea. Instead of monetary compensation for hours worked, an employer offers the employee paid time away from work instead. Comp time is also called time off in lieu (TOIL).

Comp time can be offered when an employee works beyond their usual hours:

- So, let’s say your employee usually works 35 hours a week, but they worked seven extra hours during a week in order to complete a big project.

- You might encourage them to take a paid day off the following week, without having to use their accumulated PTO, thus compensating them with the equivalent of 7 hours.

Comp time is often viewed as an alternative to paying overtime rates—as a cost-saving measure for an organization—but that’s only legally permissible in limited cases (covered further down).

Comp time as an employee benefit

Comp time can also simply be a positive way to provide flexibility and show appreciation to employees. This is especially true where there’s no obligation to pay overtime, such as your salaried workforce.

Where an employee receives a salary, their income is generally seen as compensation for any and all hours worked, as per conditions set out in their employment contract—with no provision for overtime. However, employers can choose to reward and recognize salaried employees, which can include bonuses, commissions, overtime, and paid time off (e.g., comp time).

Why might an employer do so?:

- To differentiate their employer brand and attract top talent.

- To motivate and inspire healthy competition among employees.

- To give managers more avenues to enable work-life balance and reduce burnout.

Is comp time legal?

While it may be common practice in some workplaces, depending on the type of employee and workplace it may not be legal to offer comp time. The most obvious situation where comp time is prohibited is when an employee is legally entitled to overtime pay.

In the US, federal labor laws make it illegal to avoid paying overtime to eligible workers (unless they’re exempt) when they go over 40 hours in a typical work week—which would require extra hours to be compensated at 1.5X the usual rate of pay (aka, ‘time and a half’).

Various state laws can also apply. For instance, California has additional overtime rules in place that protect most workers, including many salaried employees—and comp time can be taken, but only at the employees’ request and where a written agreement is in place.

To legally offer comp time, you’ll need to carefully determine:

- Whether your employees are exempt or non-exempt according to federal laws?

- Relevant state-based laws, based on where the employee works, that may apply?

What is a non-exempt employee?

Non-exempt employees are entitled to the minimum wage and overtime requirements. In the private sector, most workers paid on an hourly rate would be covered by the Fair Labor Standards Act (FLSA), and therefore be entitled to overtime when they work beyond 40 hours.

According to the US’ Department of Labor, for non-exempt employees under FLSA laws: “The overtime pay requirement cannot be met through the use of compensatory time off (comp time) except under special circumstances applicable only to state and local government employees.”

Which workers are exempt from FLSA overtime?

Salaried, full-time employees are generally exempt from overtime requirements, which is sometimes referred to as the EAP exemption (with EAP standing for Executive, Administrative and Professional).

Exempt employees in the business sphere typically hold ‘white collar’ roles such as:

- Senior business leaders and executives.

- Administrative office workers involved in business operations, and outside sales.

- Computer-based roles such as analysts, software engineers, programmers and developers

- Professionals with advanced knowledge doing work that is ‘predominantly intellectual’ in nature, or that requires inventiveness and talent related to artistic or creative work.

The exemptions only apply where the job being performed meets certain criteria (e.g., for an executive, the work must include management tasks, supervisory responsibilities and hiring powers) and provided the employees’ annual salary is a minimum of $35,568 annually, which equates to at least $684 per week.

Other employees exempt from overtime pay (but not minimum wage) include:

- Some retail and service workers who work on commission, and auto and farm equipment salespeople and mechanics.

- Taxi drivers, delivery drivers, and employees of railroads and air carriers.

- Broadcast news announcers and editors.

- Live-in domestic service workers.

- Employees of movie theaters.

- Farmworkers.

Recent changes to the regulations around exempt workers by the US Department of Labor include a 2023 proposal to revise the rules for determining whether salaried workers are exempt. The Department again seeks to increase the standard salary level—to $1,059 per week—as well as set up an automated mechanism to update earnings thresholds every three years in line with current wage data. The proposal is open to comments from the public until 7 November, 2023.

The exception for non-exempt government employees

As mentioned above (and somewhat confusingly), while many state and local government employees would be defined as ‘non-exempt’, they can be offered comp time. Public sector employees are an exception to the rule.

Of course, the FLSA includes rules that govern how comp time is provided to public sector employees, which includes:

- The need for an up-front agreement or understanding that comp time will be provided.

- Rules around how comp time is paid out, when it can be taken and how it’s paid if an employee resigns.

- Limits on the amount of comp time that can be accrued.

Risks of illegally using comp time

Not adhering to US federal labor laws can be highly costly for employers. As well as having to re-pay wages and damages owed to employees, violations of the requirement to pay overtime can result in criminal prosecution, monetary fines of up to $10,000, or even imprisonment.

When and why should you provide comp time?

Whether you provide comp time for employees exempt from overtime laws should be clearly planned and articulated as part of your broader workforce management and HR policies. It makes sense to engage your team and seek their feedback on the value of comp time.

If you go down this path, you’ll want to make sure your line managers have the capabilities to monitor and track people’s workloads, hours worked, productive time and working patterns—to avoid employees unnecessarily putting in extra hours to access comp time.

Avoiding misuse of comp time as a benefit comes down to:

- Clarity for employees and managers about the comp time policy—especially around when overtime is required, how it is approved, and when and how comp time is accessed. This reduces the chances of comp time being unevenly applied by managers across different teams, which can create resentment and negatively impact culture and morale.

- Being able to fairly assess both hours worked and performance during hours worked, as well as manage the workflows around monitoring and approving extra time and tasks. With clear oversight of time worked across every team member, you can more easily spot poor workload management across teams or poor time management at an individual level.

How do you calculate comp time?

If you’re providing comp time as additional compensation to a salaried worker, it’s at your discretion how you’ll calculate comp time.

Where you’re providing comp time instead of overtime as part of a formal agreement with employees—where legally allowed—it would be calculated the same way you’d calculate overtime pay: every hour worked over 40 hours is multiplied by 1.5.

As an equation, it looks like this:

(Total hours worked during a week – 40 hours) X 1.5 = Comp time due.

How is Time Doctor used to track comp time?

Providing comp time to employees can become complicated and more likely to be disputed if you’re not crystal clear on when employees actually worked.

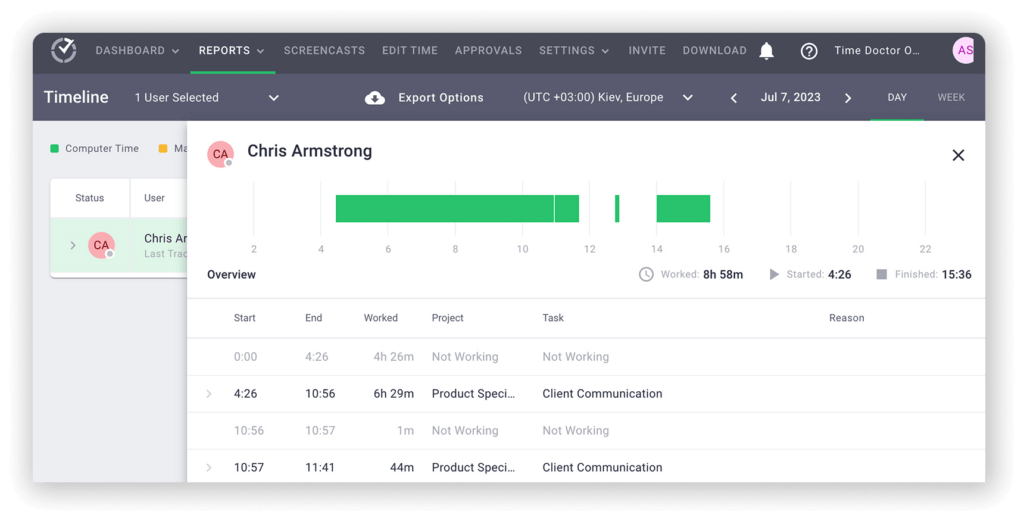

An automated and employee-friendly time tracking tool like Time Doctor makes it simple for both employees and their managers to capture and analyze every hour worked, even across multiple, staggered shifts that might not reflect a typical 9-5 schedule.

Keeping and maintaining accurate records about hours worked each day, and total hours worked each week—as well as regular and overtime earnings—is another requirement of employers regarding employees subject to US labor laws. While any timekeeping method is acceptable “as long as it is complete and accurate”—we’d argue that most manual and analog techniques put you at risk of errors, gaps and lost data that can’t easily be found or audited in years to come.

Even if your team is employed on salaries, and exempt from minimum wage and overtime requirements, being able to track time, monitor activities and measure productivity provides an excellent foundation for fairer compensation long-term.

Similarly, if you’re keen to limit the need for either overtime pay or comp time, you need effective systems in place that:

- Alert managers when employees are approaching maximum work hours or wasting significant amounts of work time on unproductive activities;

- Helps managers spot teams or roles that regularly exceed maximum hours, where a strategic or resourcing intervention may be needed.

These patterns can be hard to detect across a workforce if you’re not receiving aggregated data about time worked presented via easy-to-interpret reports and dashboards—another area where Time Doctor stands apart in the employee monitoring market.

Want to improve your ability to track and compensate employees accurately? Request a demo of Time Doctor today.

Carlo Borja is the Content Marketing Manager of Time Doctor, a workforce analytics software for distributed teams. He is a remote work advocate, a father and a coffee junkie.