Article summary:

15 alternatives comparison table

What are hidden currency exchange fees?

How does Wise (formerly TransferWise) Work?

What do we use for international transfers?

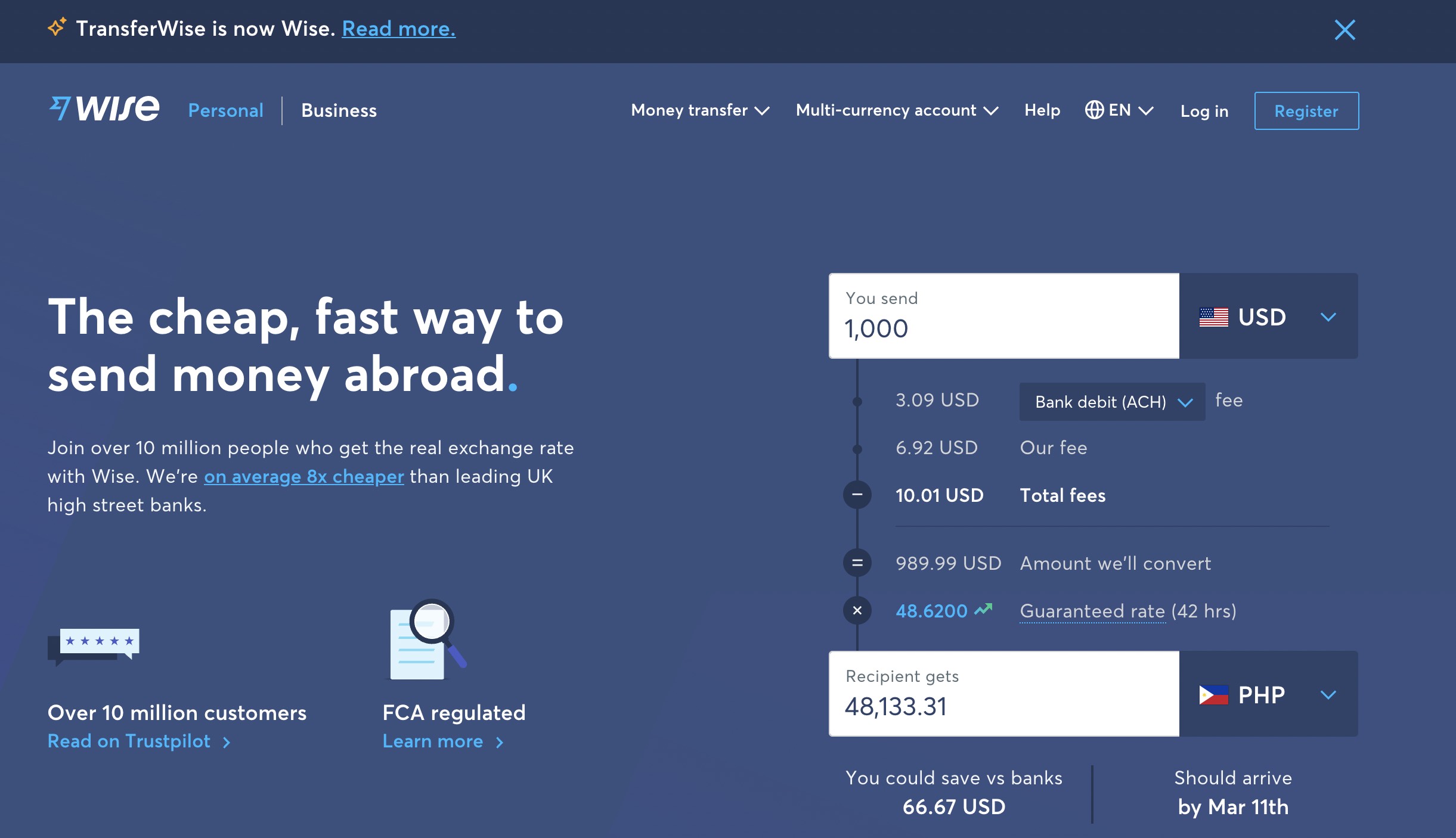

Wise (formerly TransferWise) is a relatively new transfer company that is funded by Sir Richard Branson in the UK and has been taking the world by storm. Most services have a hidden currency conversion fee; however, Wise has a fixed declared fee that is usually between 0.5-1% of the transfer.

Let’s check out some Wise alternatives below:

| Alternative | Hidden Conversion Fee* | Benefits compared with Wise (formerly Transferwise) |

|---|---|---|

| CurrencyFair* | 0-0.5% | They have a marketplace that allows you to trade directly with other participants so the overall fee can be lower than other options, especially for large amounts |

| Ria Money Transfer | 0.3-1% | Recipient can get the money in cash; however, this is mostly for sending from the US |

| OFX | 0.5-1% | Fees can be lower for large transactions and some currency pairs |

| Western Union | 1-3% | Can pay via credit card and receive the money in cash |

| Payoneer | 1-3% | They have a debit card where the recipient can receive money from an ATM |

| PayPal | 2.5-4% | Convenient |

| MoneyGram | 1-3% | Recipient can get the money in cash |

| Banks | 1-5% | |

| Xoom | 0-5-1% | |

| WorldRemit | 1.5-2% | |

| Transfast | 1-2% | |

| OrbitRemit | 1-2% | |

| Paysera | 1-2% | |

| Skrill | 5% | |

| Travelex | 10-20% |

- The hidden currency fee varies a lot for each currency pair, so this is really a rough estimate. Also note, several of the services listed above do declare the fee, so it’s not exactly a hidden fee. However, even for services that do declare the fee, it is not always easy to find or understand.

- There are many more options that are available for specific currency pairs and are not listed above.

- Five free transfers with CurrencyFair.

What are hidden currency exchange fees?

Most transfer services and banks charge a hidden fee when transferring money between currencies. This is a fee but they mostly do not declare it, so it’s a hidden fee. Let’s check out a specific example:

As of the date of writing this blog post, the rate on Western Union for transferring US dollars to Indian Rupees is 67.336

The true rate (called the interbank rate) is 68.1775

You can see this on a site like Bloomberg.

The difference between these two rates is 1.2%. So, in this case, Western Union is taking a 1.2% hidden currency conversion rate fee on this currency pair.

Unfortunately, this makes it very difficult to compare currency conversion services because they do not declare the hidden fee in most cases.

How does Wise work?

With Wise, formerly TransferWise, you make a local bank transfer to Wise, they exchange currencies, then they make a local transfer to the recipient on the other side. This means, for example, that you cannot pay with your credit card for the service. Why not? If you pay via credit card, it costs at least 1% in fees, a fee that Wise is going to have to pass on to you. This service is trying to reduce the fees as much as possible so charging you for Credit Card fees would increase the service rate.

You can currently use Wise to transfer FROM the following currencies:

Euro, Pounds Sterling, US dollars, Australian dollars, Swiss Franc, Canadian Dollars, Polish Zlaty, Swedish Krona, Norwegian Krone, Danish Krone, Hungarian Florint, Czech Koruna, Bulgarian Lev, Romanian Leu, New Zealand Dollars, Japanese Yen, Brazilian Real, Singapore Dollars.

Wise can SEND to all of the above currencies and the following additional currencies:

Indian Rupee, Hong Kong Dollars, Malaysian Ringgit, Philippine Peso, Pakistani Rupee, Moroccan Dirham, Thai Baht, Emirati Dirham, Ukrainian Hryvna, Indonesian Rupiah, Colombian Peso, Georgian Lari, Turkish Lira, Mexican Peso, and South African Rand.

What do we use in our company for international transfers?

We have over 60 contractors in 18 different countries, so we have a real need for international transfers. We basically use two different services:

- Wise, formerly TransferWise – yes, we use Wise also in-house because we find it one of the lowest cost methods available. Their system is based on local bank account transfers, which makes transfers abroad cheaper than what banks or other providers charge. They charge a small upfront fee between 0.5% and 2% for transactions, depending on the route.

- Payoneer – this is the most convenient method we have for sending and receiving to multiple countries. This service also offers users the ability to withdraw money on a debit card at an ATM. This is very different from the way that Wise works where the recipient must receive money via their local bank account.

Rob Rawson is a co-founder of Time Doctor which is software to improve work productivity and help keep track of what your team is working on, even when working remotely.